Finance and Accounting

The parish council is subject to the Audit Commission Act 1998 and the Accounts and Audit (England) Regulations 2011.

A local council's financial year begins on 1st April and ends on 31st March in the following year. Legislation requires the council to prepare accounting statements for each financial year, which must be externally audited. These are produced in the form of an annual return which summarises the accounts and includes an annual governance statement. The external audit of a council's annual return provides a professional audit of a councils annual income and expenditure and a review of the governance by someone that is independent to the council.

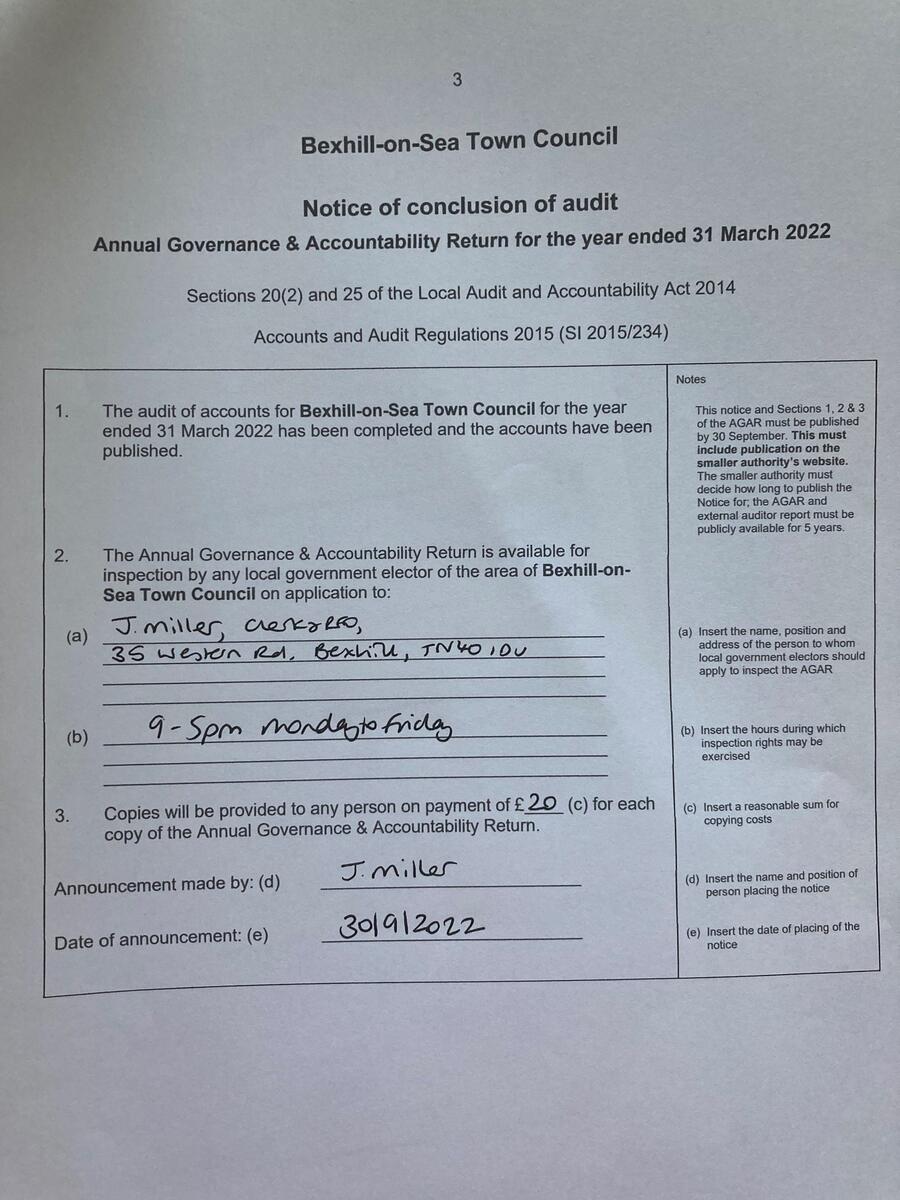

The council appoints an RFO (Responsible Financial Officer) to determine the council's accounting records and systems. The legal responsibility of safeguarding public funds always remains with the council and its councillors. By the 30th of June each year it is the council's legal duty to consider and formally approve its records. By 30th September in each year the council must publish its annual accounting statements together with its external auditor's certificate.

Every year the council approves its 'Financial Regulations' these are the rules by which the council will manage its finances and discharge its duty to procure products and services at best value.

PRECEPT

The Town Council forecasts the amount of funding it will require for the following year and requests this funding from Rother District Council in the form of a precept tax that is included within the local Council Tax. A Council Tax base is calculated by equating to the number of Band D equivalent properties in each parish after accounting for items such as:

- Property numbers in each band during the year (i.e. including the results of changes and appeals)

- Benefit relief discounts and exemptions

- Provision for bad or doubtful debts

- Allowance for growth

The tax base figures are expressed as Band D equivalents in accordance with the relevant regulations. This means that a property in Band B will be expressed as being equivalent to 7/9ths (or 0.8) of a Band D property whilst a property in Band H will be expressed as two Band D properties.